Introduction:

In the dynamic landscape of global finance, staying abreast of fast financial news has become more crucial than ever. The financial markets are influenced by a myriad of factors, from geopolitical events to economic indicators, and the ability to process and react to information swiftly can make the difference between success and setbacks for investors. This article delves into the world of fast financial news, exploring the challenges it presents and providing strategies for individuals to stay informed and make well-informed decisions.

Challenges of Fast Financial News:

While the speed of information is a boon, it also presents challenges. The sheer volume of financial news can be overwhelming, making it difficult to filter out noise and focus on relevant information. Additionally, the risk of misinformation or fake news impacting market sentiment is ever-present, requiring investors to be discerning in their consumption of news.

Strategies for Efficient Information Consumption:

1. Utilize News Aggregators:

Employing news aggregators is a prudent strategy to streamline the information flow. Platforms like Bloomberg, Reuters, or CNBC compile relevant news stories, enabling users to access a curated feed of information tailored to their interests.

2. Customize Alerts and Notifications:

Tailoring notifications to receive breaking news related to specific stocks, industries, or economic indicators can help individuals stay focused on what matters most to their portfolios. Many fast financial news apps allow users to set custom alerts for price movements, earnings reports, or market trends.

3. Follow Reliable Financial Sources:

Trustworthy sources are paramount in the financial realm. Following reputable financial news outlets, official government releases, and statements from central banks can provide accurate and timely information. Reliable sources contribute to making well-informed decisions.

4. Leverage Technology:

Embrace technology to your advantage. Natural language processing and sentiment analysis tools can help gauge market sentiment, while algorithmic trading platforms can execute trades based on predefined criteria in real-time. These technological tools empower investors to keep pace with the speed of financial markets.

The Need for Speed:

Financial markets operate in real-time, and information travels at the speed of light. In this environment, delayed access to crucial news can lead to missed opportunities or, worse, substantial financial losses. The need for speed in processing financial news has given rise to advanced technologies and algorithms that can parse vast amounts of data in milliseconds.

The Impact of Social Media:

Social media has emerged as a potent force in disseminating financial news. Platforms like Twitter and Reddit are hubs for real-time discussions and breaking news. However, the unfiltered nature of these platforms requires users to exercise caution and cross-verify information before making decisions based on social media-driven narratives.

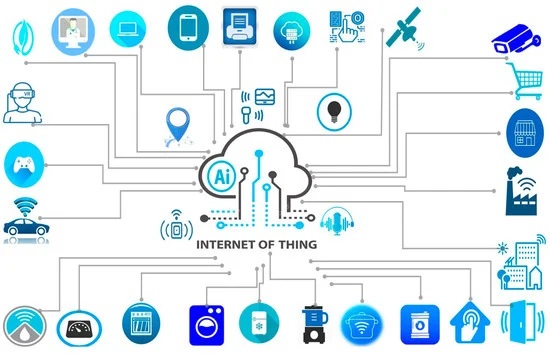

The Role of Artificial Intelligence:

Artificial Intelligence (AI) has revolutionized the financial industry. Machine learning algorithms can analyze vast datasets and identify patterns, helping investors make data-driven decisions. AI-driven robo-advisors are gaining popularity, offering automated portfolio management based on real-time market conditions.

Risk Management in Fast-Moving Markets:

The rapid pace of financial news can create a heightened sense of urgency, potentially clouding judgment. Implementing effective risk management strategies becomes crucial in volatile markets. This includes setting stop-loss orders, diversifying portfolios, and maintaining a long-term investment perspective.

Case Studies: Real-Time Decision Making:

Examining case studies of successful real-time decision-making in response to fast financial news can provide valuable insights. Whether it’s a timely exit from a declining market or capitalizing on a sudden surge in stock prices, understanding how others navigated volatile situations can inform one’s own approach.

Conclusion:

In the era of fast financial news, being equipped with the right tools and strategies is essential for success. The ability to sift through information, distinguish between noise and substance, and make informed decisions in real-time can be a game-changer. By leveraging technology, following reliable sources, and adopting prudent risk management practices, investors can navigate the rapid currents of fast financial news with confidence. Staying informed and agile in a dynamic financial landscape is not just a competitive advantage—it’s a necessity.